What Is Portfolio Diversification? — Complete Beginner Guide to Reducing Investment Risk

Portfolio diversification is one of the most important concepts in investing. It is a core principle used by professional investors, fund managers, and financial planners to reduce risk and improve long-term stability. Yet many beginners either misunderstand it or ignore it — and that often leads to unnecessary losses.

Diversification does not guarantee profits, but it is one of the most effective ways to manage risk without sacrificing long-term growth.

In this complete guide, you will learn what portfolio diversification is, how it works, why it matters, how to build a diversified portfolio, and what mistakes to avoid.

What Is Portfolio Diversification?

Portfolio diversification means:

Spreading your investments across different asset types, sectors, industries, and geographic regions instead of putting all your money into one investment.

Simple idea:

Don’t put all your money in one place.

Instead of buying only one stock or one asset, you build a mix — so that if one investment performs poorly, others can help balance the result.

Simple Example of Diversification

❌ Non-Diversified Portfolio

- 100% money in one company stock

If that company drops 40% → your portfolio drops 40%.

✅ Diversified Portfolio

- 40% index fund

- 25% bonds

- 20% international stocks

- 10% gold

- 5% cash

If one asset falls — others may remain stable or rise.

Risk impact is reduced.

Why Diversification Matters

Diversification protects investors from concentration risk — the danger of being too dependent on one investment.

Key Benefits

✅ Risk Reduction

Loss in one asset does not destroy entire portfolio.

✅ Smoother Performance

Returns become more stable over time.

✅ Lower Volatility

Portfolio swings are reduced.

✅ Better Risk-Adjusted Returns

You may achieve similar returns with lower risk.

The Core Principle Behind Diversification

Different assets behave differently under the same economic conditions.

Example:

- Stocks may fall during recession

- Bonds may hold steady

- Gold may rise during uncertainty

- Cash remains stable

Because asset behaviors are not identical, combining them reduces total portfolio risk.

This is called low correlation between assets.

Types of Diversification

Diversification is not just about owning “many things.” It has layers.

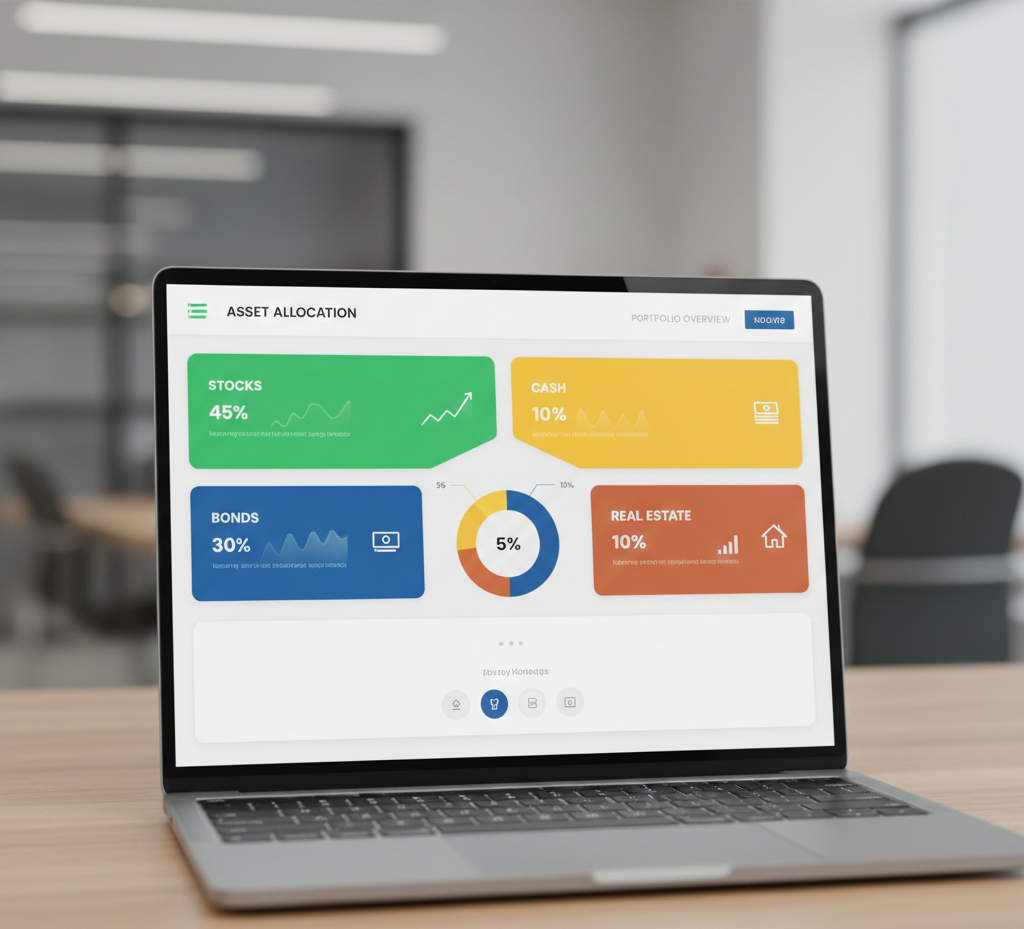

1️⃣ Asset Class Diversification

Spread across major asset categories.

Major Asset Classes

- Stocks (equities)

- Bonds (fixed income)

- Cash equivalents

- Real assets (gold, real estate funds)

This is the most important diversification layer.

2️⃣ Industry / Sector Diversification

Within stocks, diversify across sectors.

Examples:

- Technology

- Healthcare

- Finance

- Energy

- Consumer goods

- Industrials

Avoid putting all stock money into one sector.

Sector crashes happen.

3️⃣ Geographic Diversification

Invest across countries and regions.

Examples:

- US markets

- Europe

- Asia

- Emerging markets

- Global funds

Different economies grow at different times.

Global exposure reduces country risk.

4️⃣ Company Size Diversification

Mix different market capitalizations.

- Large-cap companies

- Mid-cap companies

- Small-cap companies

Each behaves differently across cycles.

5️⃣ Investment Style Diversification

Blend investment styles.

- Growth investing

- Value investing

- Dividend investing

- Index investing

Style cycles rotate over time.

The Easiest Way for Beginners to Diversify

Beginners do not need to manually buy dozens of assets.

The easiest method:

✅ Use Broad Index Funds

One total market index fund can provide exposure to hundreds or thousands of companies.

✅ Use ETFs

Broad ETFs give instant diversification.

✅ Use Target-Date Funds

Automatically diversified and adjusted over time.

These tools provide built-in diversification.

Example Beginner Diversified Portfolio

Moderate Risk Example

- 60% total market index fund

- 20% bond index fund

- 10% international index fund

- 10% gold or defensive asset

Simple. Diversified. Low maintenance.

Diversification vs Diworsification

Too much complexity can reduce efficiency.

Owning:

- 12 similar tech funds

- 8 overlapping ETFs

Is not real diversification — it is duplication.

This is sometimes called diworsification.

Quality diversification > quantity of holdings.

What Diversification Does NOT Do

Important truth:

Diversification does NOT:

- Guarantee profit

- Prevent all losses

- Eliminate market risk

- Stop broad market crashes

During major crashes, most risky assets fall together.

But diversification still reduces severity.

Correlation — The Advanced Concept (Simple Explanation)

Correlation measures how assets move relative to each other.

High Correlation

Move in same direction.

Low Correlation

Move differently.

Diversification works best when assets have low correlation.

Example:

Stocks + bonds historically have lower correlation than two tech stocks.

Rebalancing — Maintaining Diversification

Over time, asset weights change.

Example:

Stocks grow faster → portfolio becomes stock-heavy → risk increases.

Rebalance periodically:

- Sell overweight assets

- Add underweight assets

Usually done once per year.

Rebalancing maintains diversification structure.

Common Diversification Mistakes

❌ Owning Only One Stock

Extreme concentration risk.

❌ Sector Concentration

All tech or all crypto.

❌ Geographic Concentration

Only one country.

❌ Overlapping Funds

Multiple funds holding same companies.

❌ Ignoring Bonds Completely

No stabilizers in portfolio.

❌ Never Rebalancing

Allocation drifts into risk.

How Many Investments Are Enough?

There is no magic number — but general guidance:

- 1 broad index fund = already diversified

- 2–4 core funds = strong diversification

- 5–8 funds = usually more than enough

More holdings do not always mean more safety.

Diversification for Different Time Horizons

Short-Term Goals

Higher safe asset allocation.

Long-Term Goals

Higher equity allocation — but still diversified within equities.

Diversification applies at every horizon — but mix changes.

Behavioral Benefit of Diversification

Diversified investors:

- Panic less

- Stay invested longer

- Experience smoother returns

- Make fewer emotional decisions

Stability improves discipline.

Final Summary — Portfolio Diversification

Portfolio diversification means spreading investments across assets, sectors, and regions to reduce risk and stabilize returns.

Core rules:

- Don’t concentrate

- Use multiple asset classes

- Diversify within stocks

- Add geographic exposure

- Use index funds for simplicity

- Rebalance yearly

- Avoid duplication

Diversification does not remove risk — but it manages it intelligently.

It is one of the strongest foundations of successful investing.